Baker's Law: Bad Customers Drive Out Good Customers

We hold these truths to be self-evident, that all men are created equal,…—Thomas Jefferson, The Declaration of Independence, July 4, 1776

Whenever anyone quoted those immortal words from the Declaration of Independence—all men are created equal—Federalist Fisher Ames, an ardent opponent of Thomas Jefferson and a superb congressional orator, would retort: “And differ greatly in the sequel.”

While Fisher’s admonishment might not be the best way to administer a country’s laws—where all should be treated equally—it is profound when it comes to understanding no two customers are equal. A German Proverb teaches, “He who seeks equality should go to a cemetery.”

Maximum vs. Optimal Capacity

All firms have a theoretical maximum capacity and a theoretical optimal capacity. From a strategy perspective, it is essential to see how that capacity is being allocated to each customer segment. Your maximum capacity is the total number of customers you firm can adequately service, while the optimal capacity is the point at which customers can be served adequately while maintaining your competitive advantage and pricing integrity.

Insuring a proper amount of capacity is allocated to various customer segments, while offering a differentiating value proposition within each segment, is an essential element of implementing value pricing strategies. It also prevents bad customers—those who are not willing to pay for the value you deliver—from crowding out good customers.

The Adaptive Capacity Model

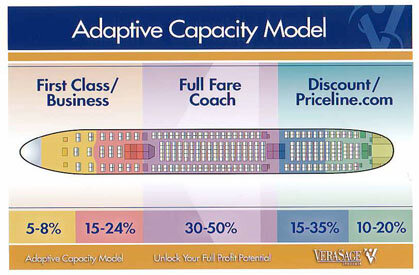

Think of your firm as a Boeing 777 airplane, similar the one below.

When United Airlines places a Boeing 777 in service, it adds a certain capacity to its fleet. However, it goes one step further, by dividing up that marginal capacity into five segments:

A. First classB. Business classC. Full fare coachD. CoachF. Leisure, Priceline.com, and Bereavement fares

The airlines—and hotels, cruise lines, golf courses, car rental agencies, and other industries with fixed capacity—are adept at managing and predicting their adaptive capacity to maximize profitability.

Lessons from Yield Management

The airlines understand it is the last–minute customer who values the seat the most and hence they reserve a portion of each plane’s capacity for their best customers. They do this even at the risk the plane will take off with some of those high price seats empty—and that revenue can never be recaptured since they cannot inventory seats.

Why do they take that risk? Because the rewards of reserving capacity for price insensitive customers comprise the majority of their profits.

Airlines allocate only so many seats to coach, leisure, Priceline.com (or bereavement) seats, which they offer well in advance of the flight. However, no airline adds capacity in order to accommodate these customers.

This point is noteworthy, as too many firms will, in fact, add capacity—or reallocate capacity from higher-valued customers—in order to serve low-valued customers. This is the equivalent of the airlines putting the upper deck in the back of the plane rather than the front.

Furthermore, many companies will turn away high–value, last minute work from its best customers because it is operating near maximum capacity, usually at the low–end of the value curve for price sensitive customers. This is common during peak seasons; the lost profit opportunities are incalculable.

Many worry about running below optimal capacity and cut their prices in order to attract work, especially in downturns or slow cycles. This strategy is fine, but you must understand the tradeoff you’re making. Usually, that capacity could be better utilized selling more valued-added services to your first–class and business-class customers, who are less price sensitive than new customers.

This way, the firm does not cut its price and degrade its pricing integrity in order to attract price sensitive customers, sending a signal into the marketplace it is willing to engage in this strategy and affecting the perception of its value proposition.

The conventional wisdom is you have to be at maximum capacity—where demand exceeds supply—to raise prices. But since when do you have to wait to be fully booked to demand a premium price? Do not confuse working harder (supply-side capacity) with working smarter (demand side pricing).

Prices are determined by value created for the customer, not the internal capacity constraints of your firm.

How much fixed capacity are you allocating to each customer class? What will be the criteria you use to ascertain where in your airplane each customer sits?

By viewing your firm as an airplane with a fixed amount of seats, you will begin to adapt your capacity to those customers who appreciate—and are willing to pay for—your value proposition.