How should professionals scope complex jobs?

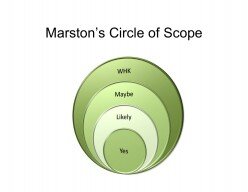

This past Friday and Saturday, Chris Marston and I had the pleasure of conducting a workshop on Value Pricing for Atticus. The attorneys in the audience were a mixed group: some were family law firms, others litigators, and others still estate lawyers.When any PKF offers fixed prices, utilizing Value Pricing, scoping the project is essential. We strongly suggested Ed Kless posts on this subject.When Chris was asked how he scoped a project, he drew these concentric circles. This forces a firm to think about what they know for sure is going to happen—the Yes circle. Since the PKF is the expert, they should know, at a minimum, the work that needs to be done in the first phase. If they don't know this, perhaps they don't know enough about the customer's objectives to be able to handle the project. Everything can be broken down into phases. Mechanics will sometimes charge a price just to diagnose a car's problem, or a doctor will charge for a biopsy. The same logic applies here.Next, the firm should consider those elements that are Likely to be required. These are tasks with a high probability of being required to be performed.After that, the firm should consider those things that might be needed—the Maybe items. This is where the process, from a pricing perspective, becomes creative, for it allows firms to begin offering various bundled options. Using the American Express Green, Gold, Platinum, and Black credit card analogy, a firm only scoping the Yes items could offer a Green card price—a stripped down value proposition. This may be strategic if the customer is price sensitive.Value Pricing isn't just about offering higher value and prices. It can also mean a lower price, but always for a lower value. There should always be a trade off required from the customer. Moving beyond the Yes factors to the Likely factors could produce a Gold Card service option, at a higher price; including the Maybe factors would bring a Platinum card price. Not only are you offering various levels of comfort, you are also providing insurance to the customer against risk.This is significant because people will pay "premiums" to avoid risk—it's what insurance companies are all about. The PKF is able to spread this risk over many customers, yet the customer usually only deals with one lawyer at a time, so the risk to them is much higher. Reduce that risk and you earn a price premium. It's similar to fixed-rate vs. variable rate mortgages. The higher interest rate isn't because it cost the bank anymore to process a fixed-rate loan; rather, it's for the reduction of risk to the customer.Since profits come from risk, this is an opportunity for a PKF to make supernormal or windfall profits.If the firm can actuarially assess the risk of not only Maybe factors, but then step beyond to cover what Chris calls "Who the Hell Knows (WHK)" factors, then it is offering an insurance premium with umbrella coverage for contingencies. Some customers will value this ultimate peace of mind and be willing to pay for it—the Black Card in American Express lingo (the Black Card is a $2,000 per year credit card that comes with a 24/7/365 concierge, frequent flier miles, and other perks).Placing the project into Phases, with creative scoping, leaves the opportunity for Change Orders when the scope changes. Once the professional is approximately 80-90% done with Phase 1, they can begin to scope Phase 2. The important point here is to discuss, price, and get authorization from the customer for Phase 2 BEFORE you are done with Phase 1. This maintains the firms leverage as well as leveraging switching costs.This method of analyzing scope applies to all PKFs, from Advertising Agencies to software VARs. Give your customers options. So many professionals get hung up that they are unable to forsee all the contingencies of a job. So what? If you feel anxious about that risk, imagine how your customers feel about it.So do what the insurance companies do. Use that risk actuarially and turn it into an opportunity to create and capture more value. Give your customers the option of choosing what level of risk they are comfortable with. Since risk is like price—it is completely subjective, different for each person—some customers won't value avoiding it while others will.Profits come from risk. Chris' scoping circles will help you analyze risk in a structured, logical manner, allowing you to absorb the level of risk you're comfortable with. As with pricing, this is a skill—the more you do it, the better you'll get.Actuaries price risk for a living. If PKFs can develop a competency in this skill, they will be able to differentiate themselves in the market from their competition, as well as capture more of the value they create. That's the ultimate win-win.But it takes the ability to think, take risks, be creative, and imaginative. This is precisely why most firms don't do it, it's too hard. As Ed Kless says, if you suck at what you do, by all means price by the hour.Most professionals do this because they are afraid of scope changes. Chris Marston just provided you a way to avoid that fear, while adding tremendous value.Do you have the guts to put it into practice?

This forces a firm to think about what they know for sure is going to happen—the Yes circle. Since the PKF is the expert, they should know, at a minimum, the work that needs to be done in the first phase. If they don't know this, perhaps they don't know enough about the customer's objectives to be able to handle the project. Everything can be broken down into phases. Mechanics will sometimes charge a price just to diagnose a car's problem, or a doctor will charge for a biopsy. The same logic applies here.Next, the firm should consider those elements that are Likely to be required. These are tasks with a high probability of being required to be performed.After that, the firm should consider those things that might be needed—the Maybe items. This is where the process, from a pricing perspective, becomes creative, for it allows firms to begin offering various bundled options. Using the American Express Green, Gold, Platinum, and Black credit card analogy, a firm only scoping the Yes items could offer a Green card price—a stripped down value proposition. This may be strategic if the customer is price sensitive.Value Pricing isn't just about offering higher value and prices. It can also mean a lower price, but always for a lower value. There should always be a trade off required from the customer. Moving beyond the Yes factors to the Likely factors could produce a Gold Card service option, at a higher price; including the Maybe factors would bring a Platinum card price. Not only are you offering various levels of comfort, you are also providing insurance to the customer against risk.This is significant because people will pay "premiums" to avoid risk—it's what insurance companies are all about. The PKF is able to spread this risk over many customers, yet the customer usually only deals with one lawyer at a time, so the risk to them is much higher. Reduce that risk and you earn a price premium. It's similar to fixed-rate vs. variable rate mortgages. The higher interest rate isn't because it cost the bank anymore to process a fixed-rate loan; rather, it's for the reduction of risk to the customer.Since profits come from risk, this is an opportunity for a PKF to make supernormal or windfall profits.If the firm can actuarially assess the risk of not only Maybe factors, but then step beyond to cover what Chris calls "Who the Hell Knows (WHK)" factors, then it is offering an insurance premium with umbrella coverage for contingencies. Some customers will value this ultimate peace of mind and be willing to pay for it—the Black Card in American Express lingo (the Black Card is a $2,000 per year credit card that comes with a 24/7/365 concierge, frequent flier miles, and other perks).Placing the project into Phases, with creative scoping, leaves the opportunity for Change Orders when the scope changes. Once the professional is approximately 80-90% done with Phase 1, they can begin to scope Phase 2. The important point here is to discuss, price, and get authorization from the customer for Phase 2 BEFORE you are done with Phase 1. This maintains the firms leverage as well as leveraging switching costs.This method of analyzing scope applies to all PKFs, from Advertising Agencies to software VARs. Give your customers options. So many professionals get hung up that they are unable to forsee all the contingencies of a job. So what? If you feel anxious about that risk, imagine how your customers feel about it.So do what the insurance companies do. Use that risk actuarially and turn it into an opportunity to create and capture more value. Give your customers the option of choosing what level of risk they are comfortable with. Since risk is like price—it is completely subjective, different for each person—some customers won't value avoiding it while others will.Profits come from risk. Chris' scoping circles will help you analyze risk in a structured, logical manner, allowing you to absorb the level of risk you're comfortable with. As with pricing, this is a skill—the more you do it, the better you'll get.Actuaries price risk for a living. If PKFs can develop a competency in this skill, they will be able to differentiate themselves in the market from their competition, as well as capture more of the value they create. That's the ultimate win-win.But it takes the ability to think, take risks, be creative, and imaginative. This is precisely why most firms don't do it, it's too hard. As Ed Kless says, if you suck at what you do, by all means price by the hour.Most professionals do this because they are afraid of scope changes. Chris Marston just provided you a way to avoid that fear, while adding tremendous value.Do you have the guts to put it into practice?